US Stocks Edge Up: PCE & Sentiment Awaited

- U.S. equity markets opened positively, with Nasdaq leading gains.

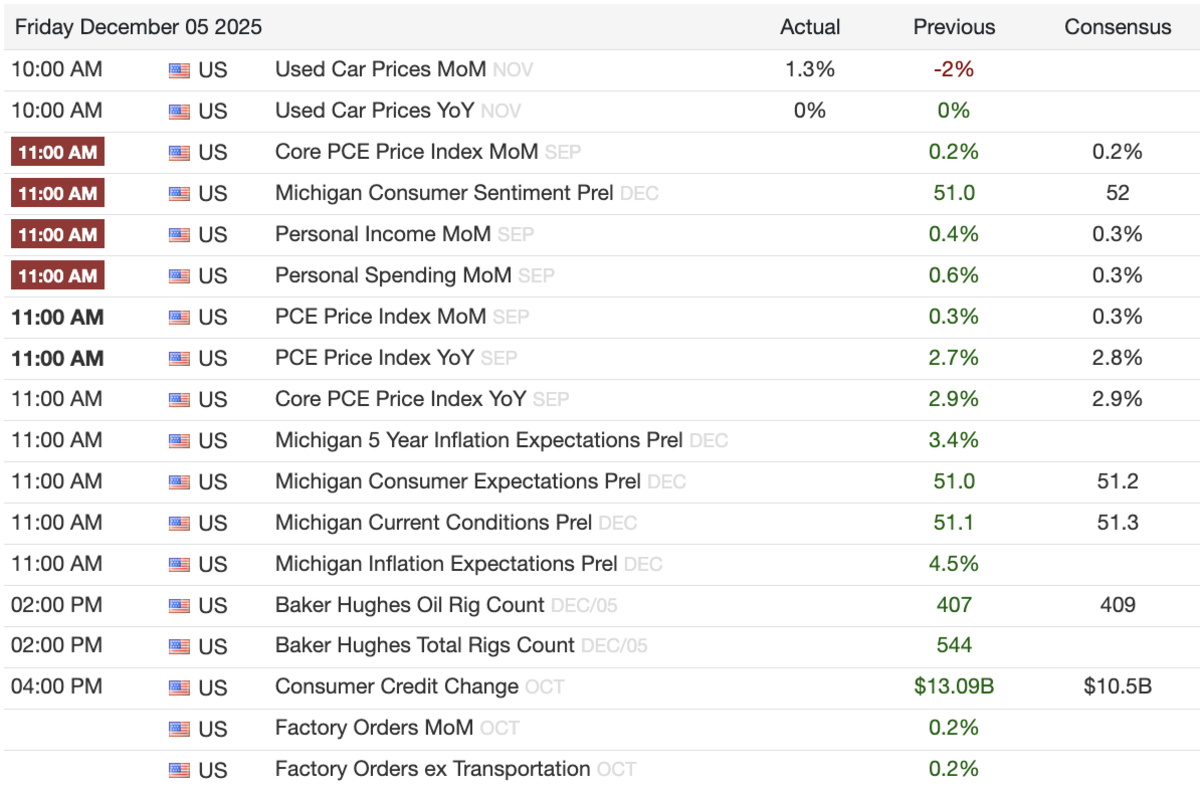

- Key economic reports, including the Core PCE Price Index and Michigan Consumer Sentiment, are highly anticipated.

- Commodity markets show mixed signals, with precious metals and natural gas advancing.

- A significant merger between Netflix and Warner Bros. Discovery has been announced, impacting entertainment stocks.

- Investors are closely monitoring these data releases for insights into inflation and consumer confidence.

As the trading week draws to a close, U.S. stock markets are demonstrating a cautious yet upward trajectory, reflecting investor anticipation of crucial economic indicators set for release later today. The financial landscape remains dynamic, with minor upticks across major indices and significant corporate developments shaping the narrative. This detailed market update aims to provide a comprehensive overview of the day's events, offering insights into market performance, key economic data points, and notable corporate news.

Investors are keenly awaiting the latest figures on personal consumption expenditures (PCE) and consumer sentiment, which are widely regarded as pivotal barometers for the nation's economic health and inflationary pressures. These reports carry substantial weight, potentially influencing Federal Reserve policy decisions and overall market direction. Understanding the nuances of these economic releases is paramount for navigating the complexities of the modern financial market, especially for those involved in fintech and investment strategies.

Market Opening: A Snapshot of Early Trading

The opening bell on this eventful Friday marked a generally positive start for U.S. equities. The technology-heavy Nasdaq Composite led the charge, recording a notable gain of 0.37%. This performance underscores the continued resilience and growth potential observed within the technology sector, a cornerstone for many fintech innovations. Following closely, the broader S&P 500 index saw an increase of 0.25%, indicating a healthy, albeit modest, positive sentiment across diverse market segments.

The venerable Dow Jones Industrial Average also joined the upward trend, advancing by 0.15%. This traditional benchmark's movement suggests a degree of stability and confidence in established industrial and blue-chip companies. Conversely, the Russell 2000, an index representing small-cap companies, experienced a slight dip of 0.15%. This minor retraction follows two consecutive days of gains for the small-cap segment, suggesting a potential rotation or profit-taking as investors recalibrate their positions ahead of significant economic announcements.

Futures Market: Commodities and Bonds in Focus

Beyond equity markets, the continuous futures contracts offered a mixed, yet intriguing, picture. Natural Gas futures demonstrated significant upward momentum, climbing 4.38% to reach $5.285. This surge in natural gas prices could be attributed to various factors, including seasonal demand forecasts or geopolitical developments impacting energy supplies. Such volatility in energy markets often has ripple effects across various industries and consumer spending.

Precious metals also saw considerable gains, with Silver futures advancing by 2.41% to $58.875 and Gold futures increasing by 0.54% to $4,266.10. The sustained interest in gold and silver often reflects a broader sentiment of economic uncertainty or a flight to safety among investors seeking hedges against inflation or market volatility. In contrast, Brent Crude futures experienced a slight decline of 0.13%, settling at $63.18, indicating a relatively stable but slightly softer demand outlook for global oil.

In the fixed-income market, the 10-Year Treasury yield showed a marginal decline of 0.8 basis points, falling to 4.10%. A decrease in bond yields typically suggests increased demand for safe-haven assets or a subtle shift in expectations regarding future interest rate movements and economic growth trajectories. These movements are critical for fintech platforms offering investment advice or managing fixed-income portfolios.

Breaking News: Entertainment Giants Merge

A major corporate development captured headlines overnight, as Netflix and Warner Bros. Discovery finalized a monumental $72 billion merger. This strategic alliance follows weeks of intense bidding and negotiations, culminating in an exclusive deal that will reshape the entertainment industry landscape. Prior to the announcement, Netflix shares experienced a decline of 4.7%, likely reflecting pre-merger speculation and the financial implications of such a massive acquisition. Conversely, Warner Bros. Discovery shares surged by 3.2%, indicating positive market reception to the acquisition by the streaming giant.

This merger has profound implications for the competitive streaming market, potentially consolidating content libraries and subscriber bases. For investors, it signifies a significant strategic move by Netflix to strengthen its market position and diversify its content offerings, thereby challenging existing competitors and setting new benchmarks for industry consolidation. The long-term effects on content creation, distribution models, and consumer choice will undoubtedly be closely monitored.

Anticipated Economic Data: PCE and Consumer Sentiment

The latter half of the trading day is poised to be significantly influenced by the release of key economic data. Foremost among these is the September Core Personal Consumption Expenditures (PCE) Price Index report. The PCE index is the Federal Reserve's preferred measure of inflation, making its release a critical event for policymakers and investors alike. A higher-than-expected reading could reignite concerns about persistent inflation, potentially influencing the Fed's stance on future interest rate hikes. Conversely, a softer reading might alleviate some of these pressures.

Simultaneously, the preliminary reading of the Michigan Consumer Sentiment for December will offer valuable insights into consumer confidence and spending intentions. Consumer sentiment is a leading indicator of future economic activity, as confident consumers are more likely to engage in spending, driving economic growth. Any significant deviation from expectations in this report could signal shifts in consumer behavior, impacting retail sectors and broader economic forecasts.

Other noteworthy economic data releases slated for today include:

- Personal Income and Spending reports for September, providing a detailed look into household financial health and consumption patterns.

- Manufacturing PMI and Services PMI for various regions, offering a glimpse into the health of different economic sectors.

- Weekly jobless claims, which provide a timely indicator of labor market conditions and employment trends.

Earnings Watch: Victoria's Secret in Focus

On the corporate earnings front, Victoria's Secret (VSCO) stands out as the sole firm with a market capitalization exceeding $1 billion reporting today. The release of its earnings report will be closely watched by investors for insights into consumer discretionary spending and the retail sector's performance. The results could provide a micro-level perspective on broader economic trends, particularly concerning fashion retail and brand performance during the holiday season.

Conclusion: A Day of Anticipation and Adjustment

In summary, this Friday presents a crucial juncture for the financial markets, characterized by cautious optimism and significant anticipation surrounding key economic data. The early market gains, coupled with substantial corporate news and dynamic commodity movements, underscore the multifaceted nature of today's investment landscape. As investors digest the incoming PCE and consumer sentiment reports, the market is poised for potential adjustments, making it imperative for stakeholders to remain vigilant and adaptable. The interplay of macroeconomic indicators and corporate strategic maneuvers will continue to define market trajectories as the year-end approaches.