Bitcoin Defends $108K Amid Whale Activity: October Outlook

Bitcoin's Resilience Amid September Whale Selling

Bitcoin (BTC) demonstrated significant resilience by defending the $108,000 support level over the last weekend, a period characterized by increased selling pressure from whales across major cryptocurrency exchanges, including Binance. This defense underscores the underlying strength of Bitcoin's market position despite considerable market volatility.

Analyzing September's Market Dynamics

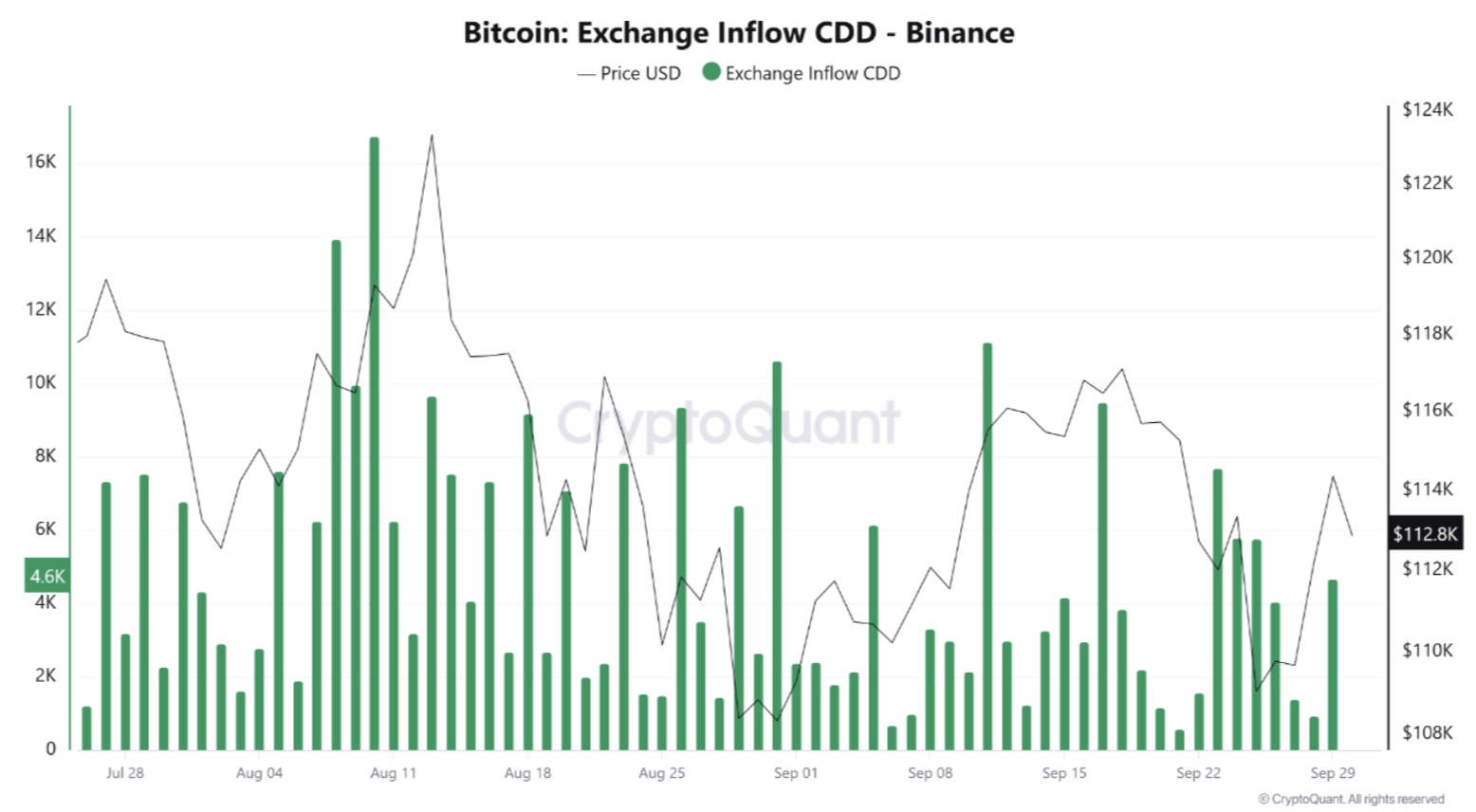

A CryptoQuant analysis by Arab Chain highlighted the tug-of-war between Bitcoin's rally attempts and the selling activities of whales and long-term holders throughout September. This fluctuation is clearly reflected in Binance's trading volume data, providing a granular view of market behavior.

The Exchange Inflow Coins Days Destroyed (CDD) indicator on Binance showed substantial volatility, with multiple peaks, particularly in mid-September. This indicator is crucial for understanding the actions of long-term investors and their potential impact on market prices.

The Exchange CDD indicator tracks the movement of older, long-held Bitcoin as it enters exchanges. Transactions are weighted by the age of the coins involved. Spikes in this indicator typically suggest that long-term holders or whales are moving their coins with the intention of selling, potentially leading to increased selling pressure. While the September peaks did not reach the extremes of previous months, the repeated spikes indicated consistent inflows from older wallets into Binance, signaling a cautious approach from long-term investors.

According to the CryptoQuant analyst, these spikes reflect a cautious sentiment among long-term investors who tested the market by moving BTC to exchanges without initiating a full-scale sell-off. These Exchange CDD spikes often coincided with price pullbacks, supporting the idea that these movements represent short-term selling pressure. However, the critical point is that these pressures did not breach the $108,000 support level, indicating sufficient buying liquidity to absorb the selling activity and maintain market stability.

In summary, while some long-term investors explored profit-taking opportunities, the absence of significant sell-offs suggests that confidence in the market remains. Bitcoin's ability to stay above $108,000, even with repeated selling pressure, confirms a robust underlying demand for the cryptocurrency.

October's Potential Trajectory for Bitcoin

Looking ahead to October, a separate CryptoQuant analysis by crypto sunmoon suggests that historical data indicates a surge in taker buy orders often precedes substantial Bitcoin bull runs. Currently, there are no strong indicators of such an increase, suggesting a potentially tempered outlook.

The analyst suggests that even if Bitcoin experiences price increases, the gains might not match previous magnitudes. However, improvements in Bitcoin network fundamentals offer some optimism. Transaction volumes are nearing the 600,000 threshold, which has historically sparked bullish momentum. Currently, BTC is trading at $113,200, a 0.6% decrease in the last 24 hours.