Solana (SOL) Price: Eyeing $200 Resistance Amidst Bullish Trend

%20cryptocurrency%20price%20movements%20over%20time.%20The%20chart%20should%20show%20an%20upward%20trend%20with%20green%20candles%2C%20indicating%20bullish%20momentum%2C%20breaking%20past%20significant%20resistance%20levels.%20Include%20elements%20of%20digital%20finance%2C%20subtle%20blockchain%20motifs%2C%20and%20a%20sleek%2C%20modern%20interface.%20The%20background%20could%20subtly%20feature%20the%20Solana%20logo%20or%20network%20elements%2C%20conveying%20growth%20and%20technological%20advancement%20in%20a%20dynamic%2C%20data-driven%20environment.%20Focus%20on%20clear%20graphical%20representation%20of%20price%20action%2C%20support%2C%20and%20resistance%2C%20suitable%20for%20a%20financial%20news%20analysis.?width=768&height=768&seed=342718&nologo=true)

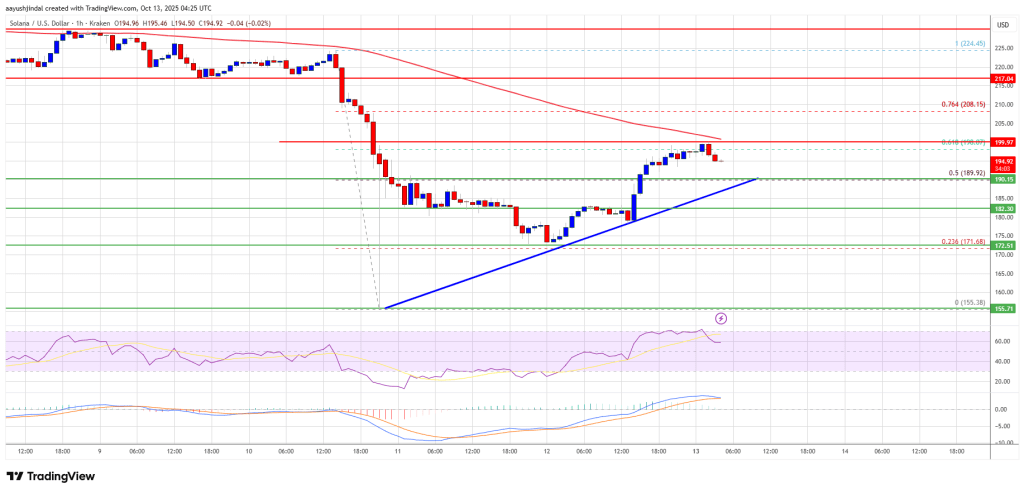

Solana (SOL) has recently demonstrated a significant resurgence in its market performance, initiating a fresh upward trajectory that has propelled its value beyond the critical $180 threshold. This latest price action has instilled a renewed sense of optimism among investors and analysts, suggesting that the cryptocurrency may have successfully established a short-term bottom following earlier downward corrections. Currently, SOL is observed to be consolidating above the $185 mark, a pivotal level that could serve as a springboard for further advancements, potentially setting its sights on breaching the formidable $200 resistance zone.

Solana's Resurgence: A Technical Analysis

The recent upward momentum in Solana's price, denoted as SOL, commenced with a robust move that saw it climb past the $175 and $180 levels when benchmarked against the US Dollar. This impressive rally has notably outpaced the performances of other major cryptocurrencies, including Bitcoin and Ethereum, underscoring Solana's intrinsic strength and market interest. The cryptocurrency's price dynamics indicate a strong short-term positive sentiment, positioning it favorably for continued growth.

Recent Price Dynamics and Key Support Levels

Solana's ability to find substantial support near the $155 zone was instrumental in initiating its current upward trend. This foundation allowed the bulls to successfully overcome the $172 level, indicating a shift in market control. Further momentum led to a decisive breach of the $180 resistance, a move that was reinforced by its ascent past the 50% Fibonacci retracement level. This Fib level is calculated from the preceding downward movement, spanning from the $225 swing high to the $155 low, signifying a strong reversal. A notable bullish trend line has also been identified on the hourly chart of the SOL/USD pair, offering robust support around the $188 level, as evidenced by data from Kraken. This trend line serves as a crucial technical indicator, reinforcing the bullish outlook for Solana.

- SOL price initiated a notable upward surge, successfully navigating above the $175 and $180 thresholds against the US Dollar.

- Presently, the price of Solana is trading below the $200 psychological barrier and beneath its 100-hourly simple moving average, indicating a cautious yet bullish sentiment.

- A significant bullish trend line has been observed, providing crucial support at the $188 mark on the hourly chart of the SOL/USD pair, based on data sourced from Kraken.

- Should the pair successfully clear the formidable $200 resistance zone, it is poised to extend its gains significantly.

Resistance Ahead: The Path to $200 and Beyond

Despite the current bullish sentiment, Solana faces immediate overhead resistance. The price is presently trading below the $200 level and also below the 100-hourly simple moving average, which typically acts as a dynamic resistance point. Initial resistance is encountered near the $198 level, which aligns closely with the 61.8% Fibonacci retracement level of the aforementioned downward move from $225 to $155. This confluence of resistance points highlights the significance of the $198-$200 range. A more substantial challenge lies at the $200 level, which represents a key psychological and technical resistance point. Overcoming this barrier is crucial for validating the continuation of the bullish trend.

Should Solana manage a successful breakout and sustain a close above the $200 resistance zone, it could pave the way for a more accelerated upward trajectory. The subsequent major resistance is projected around the $205 mark. A definitive breach and hold above $205 would significantly strengthen the bullish narrative, potentially setting the stage for a push towards the $212 level. Sustained buying pressure beyond $212 could see the price extend its gains further, aiming for the $220 level, which was a previous swing high.

Understanding Potential Downside Risks

Conversely, the market is inherently volatile, and a failure by SOL to overcome the $200 resistance could trigger a corrective decline. In such a scenario, initial support is anticipated near the $190 zone, which coincides with the aforementioned bullish trend line. A breach below this immediate support would likely bring the first major support level at $182 into play. This level is crucial, as a sustained break below $182 could signal a weakening of the bullish structure, potentially leading to a more pronounced downward movement.

If the selling pressure intensifies and the price closes below the $182 support, Solana could gravitate towards the $175 support zone. A failure to hold $175 would be a significant bearish development, potentially pushing the price further down towards the $160 support level in the near term. Investors and traders should closely monitor these key support levels to gauge the market's immediate direction and manage potential risks effectively.

Technical Indicators Overview

A review of key technical indicators provides further insights into Solana's current market standing. The Hourly Moving Average Convergence Divergence (MACD) for SOL/USD is currently exhibiting a positive momentum, gaining pace within the bullish zone. This indicates that buying pressure is accumulating and reinforces the short-term bullish outlook. Furthermore, the Hourly Relative Strength Index (RSI) for SOL/USD is positioned above the 50 level, which traditionally signifies that the asset is not overbought but has sufficient strength to support its upward movement. These indicators collectively suggest a healthy bullish sentiment.

- Major Support Levels: $188, $182

- Major Resistance Levels: $198, $200, $205

Conclusion: Solana's Short-Term Outlook

In conclusion, Solana (SOL) is demonstrating strong upward momentum, having successfully navigated key support levels and initiated a fresh rally. The cryptocurrency's ability to consolidate above $185 and the presence of a robust bullish trend line underscore a positive short-term outlook. While formidable resistance exists around the $198-$200 zone, a decisive breakthrough could unlock further significant gains, potentially leading towards the $220 level. However, market participants must remain vigilant of potential downside risks, with critical support levels at $188, $182, and $175 acting as crucial benchmarks for a potential reversal. The confluence of positive technical indicators suggests that Solana is well-positioned for continued exploration of higher price territories, provided it sustains its current bullish impetus and clears immediate resistance hurdles.