SUI Price Poised for $9: Analyst's 4 Key Bullish Factors

%2C%20high%20Decentralized%20Exchange%20(DEX)%20volume%2C%20and%20a%20growing%20stablecoin%20market%20capitalization%2C%20all%20pointing%20towards%20a%20strong%20bullish%20trend%20for%20SUI.%20The%20overall%20tone%20is%20optimistic%20and%20data-driven.?width=768&height=768&seed=188145&nologo=true)

The year 2025 has presented a rather mixed performance for the SUI cryptocurrency, initiating with an impressive surge that saw its price reach an all-time high of $5.35 on January 4. However, this initial momentum proved fleeting, as the asset has since retraced significantly, now trading more than 53% below its peak. This downturn has cast a shadow on investor sentiment, prompting a closer examination of its future trajectory.

Amidst this challenging market environment, a prominent analyst on the social media platform X has put forth a compelling bullish case for SUI, predicting a substantial price increase towards the $9 mark in the coming months. This optimistic outlook is underpinned by a combination of robust technical indicators and encouraging on-chain developments, suggesting a potential reversal of its recent downtrend.

Technical Foundations: The Symmetrical Triangle Pattern

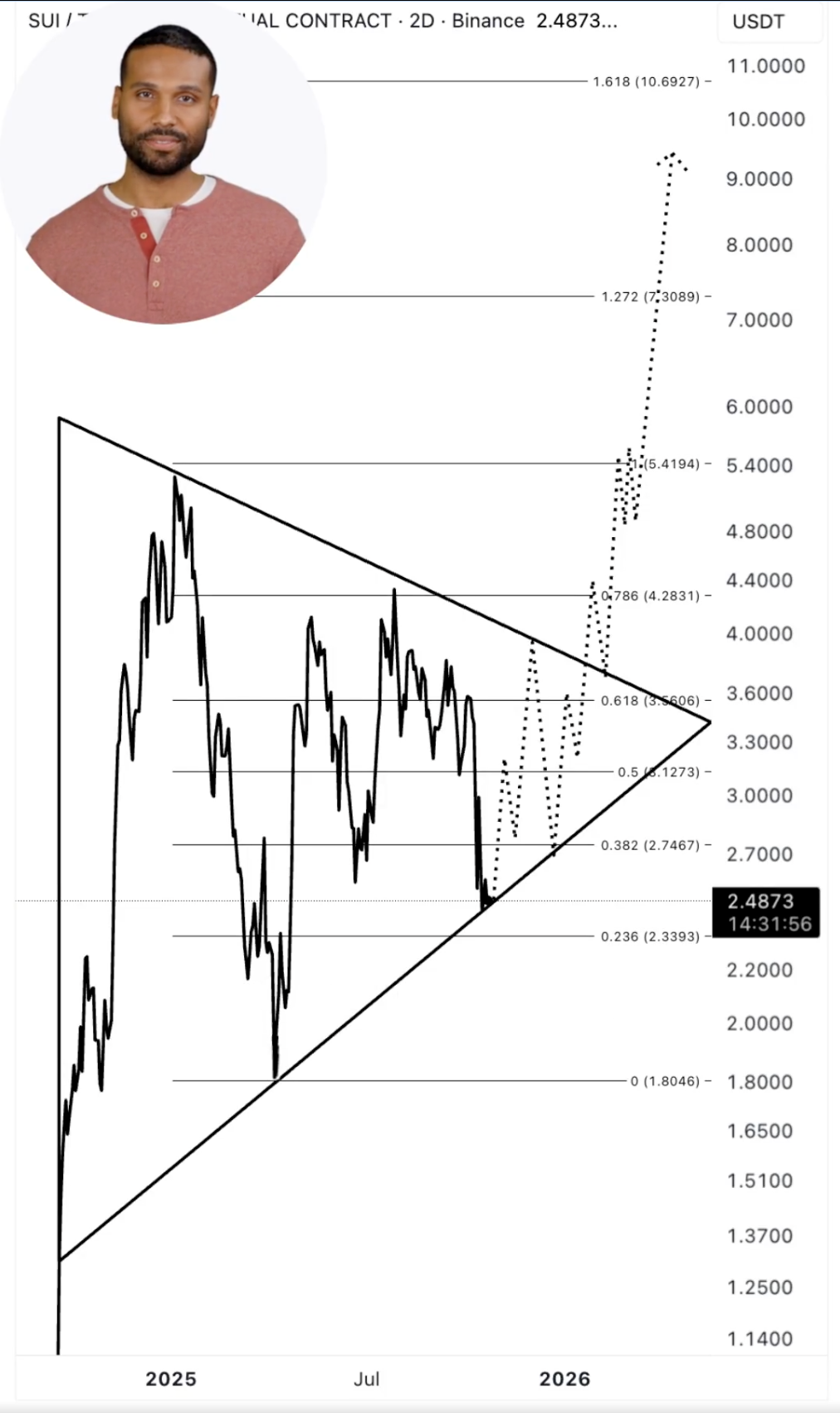

A cornerstone of this bullish thesis lies in the technical analysis of the SUI token's price action. According to market pundit Ali Martinez, SUI is currently forming a symmetrical triangle pattern on its 2-day timeframe chart. This particular chart pattern is a widely recognized technical formation characterized by converging trendlines: a descending upper trendline indicating lower highs and an ascending lower trendline signifying higher lows. The price typically consolidates within these boundaries, moving towards the triangle's apex.

In the realm of technical analysis, a symmetrical triangle can function as either a continuation or a reversal pattern, its ultimate direction being determined by the subsequent price breakout. Given SUI's prior upward trajectory before entering this consolidation phase, Martinez posits that a breakout above the upper trendline is the more probable outcome. Such a move would signal a continuation of the initial bullish impulse.

Should SUI successfully sustain a close above the critical $3.6 resistance level, which marks the upper boundary of this symmetrical triangle, the analyst projects a significant upward move. This breakout could propel the SUI price to an ambitious target of $9, representing an astounding surge of over 260% from its current trading price of approximately $2.51. This technical setup provides a strong graphical representation of potential future price action, offering a roadmap for investors.

Compelling On-Chain Catalysts for SUI Price Growth

Beyond the technical patterns, the analyst points to three significant on-chain developments that further bolster the bullish argument for the SUI token. These fundamental metrics provide a deeper insight into the health and activity of the SUI blockchain, suggesting organic growth and increasing adoption.

1. Record-High Total Value Locked (TVL)

Firstly, the Total Value Locked (TVL) on the SUI blockchain has recently achieved an unprecedented milestone, soaring to an all-time high of $2.6 billion. TVL represents the total value of assets staked or locked within a decentralized finance (DeFi) protocol or blockchain. A rising TVL is a crucial indicator of robust capital inflow and growing confidence among users and developers in the network's ecosystem. This surge suggests that more capital is being deployed and utilized within the SUI ecosystem, underscoring its increasing utility and appeal.

2. Surging Decentralized Exchange (DEX) Volume

Secondly, the volume of activity on decentralized exchanges (DEXs) operating on the SUI network has also experienced a remarkable ascent. In October, the monthly DEX volume reached a new record high of $20.33 billion. This significant increase in trading activity is particularly noteworthy as Martinez emphasizes that this spike is driven by genuine network engagement rather than merely transient incentive programs. High DEX volumes typically indicate a vibrant and active user base, fostering liquidity and facilitating efficient asset exchange within the ecosystem, which are strong fundamentals for any cryptocurrency.

3. Expanding Stablecoin Market Capitalization

The third crucial on-chain development highlighted is the impressive growth in the stablecoin market capitalization on SUI, which has now reached $1.15 billion. Stablecoins play a vital role in the crypto ecosystem by providing stability and acting as a bridge between traditional finance and decentralized applications. A substantial and growing stablecoin market cap on a blockchain like SUI signifies several positive aspects: increased user adoption, higher liquidity for trading pairs, and a stronger foundation for developing diverse DeFi applications. This expansion underscores the network's steady organic growth and robust demand for its infrastructure and services.

Conclusion: A Confluence of Bullish Indicators

In summation, the collective evidence presented by both the technical analysis and the on-chain metrics paints a compelling bullish picture for the SUI price. The formation of a symmetrical triangle on the 2-day chart, signaling a potential continuation of its upward trend, combined with the unprecedented growth in TVL, DEX volume, and stablecoin market capitalization, creates a strong foundation for future appreciation. While past performance is not indicative of future results, the confluence of these positive indicators suggests that SUI is well-positioned for a significant price surge, potentially reaching the $9 target as projected by the analyst. Investors and enthusiasts alike will be closely monitoring SUI’s performance in the coming months as these factors continue to unfold.