Ethereum Whale's $500M DeFi Move: ConcreteXYZ & Stable Vaults

The cryptocurrency market continues to navigate a period of heightened uncertainty, with Ethereum (ETH) encountering persistent challenges in breaching the significant $4,000 psychological and technical resistance level. Despite repeated attempts by bullish forces, a sustained upward momentum has proven elusive, suggesting considerable hesitation and profit-taking at these critical junctures. Amidst this cautious sentiment, recent on-chain data has revealed a monumental shift in liquidity, drawing considerable attention to a potential catalyst that could profoundly influence Ethereum's forthcoming market trajectory.

A Strategic Liquidity Infusion: The Ethereum Whale's Bold Maneuver

Insightful analysis from Lookonchain, a prominent blockchain analytics platform, has brought to light an extraordinary transaction executed by a long-standing and influential Ethereum holder, commonly referred to as an "Ethereum OG." This entity, commanding an impressive portfolio of 736,316 ETH, valued at approximately $2.89 billion, strategically deposited a substantial sum of $500 million in USDT into the nascent vaults launched by ConcreteXYZ and Stable. Remarkably, this significant capital injection occurred just prior to the official public announcement of these platforms, a timing that has ignited widespread speculation and curiosity across the global crypto community. This calculated move strongly suggests a deliberate and strategic positioning, potentially in anticipation of substantial yield generation or a significant role in future liquidity provision.

ConcreteXYZ is heralded as a cutting-edge liquidity protocol, meticulously engineered to bridge the divide between traditional institutional capital and the burgeoning decentralized finance (DeFi) ecosystem. Through its innovative tokenized vault structure, ConcreteXYZ empowers participants to allocate a diverse range of assets, including stablecoins and other crypto-native assets, into sophisticated yield-bearing strategies. A core tenet of its design is the commitment to maintaining complete transparency and seamless composability within the robust Ethereum network, fostering an environment conducive to sophisticated financial engineering.

The sheer scale and pre-emptive nature of this whale's deposit—occurring before public disclosure—underscore a potential for insider knowledge or, at minimum, a profound conviction in the long-term viability and profitability of these specific vaults. Historically, such colossal inflows from individual entities often serve as potent early indicators of impending shifts in liquidity dynamics. This holds particularly true when these movements align with projects strategically positioned at the confluence of advanced DeFi infrastructure and the increasingly interconnected world of institutional finance. The implicit message conveyed by such a substantial, early commitment can significantly influence market perception and subsequent investment flows.

DeFi Dominance: The Aave-ConcreteXYZ Connection

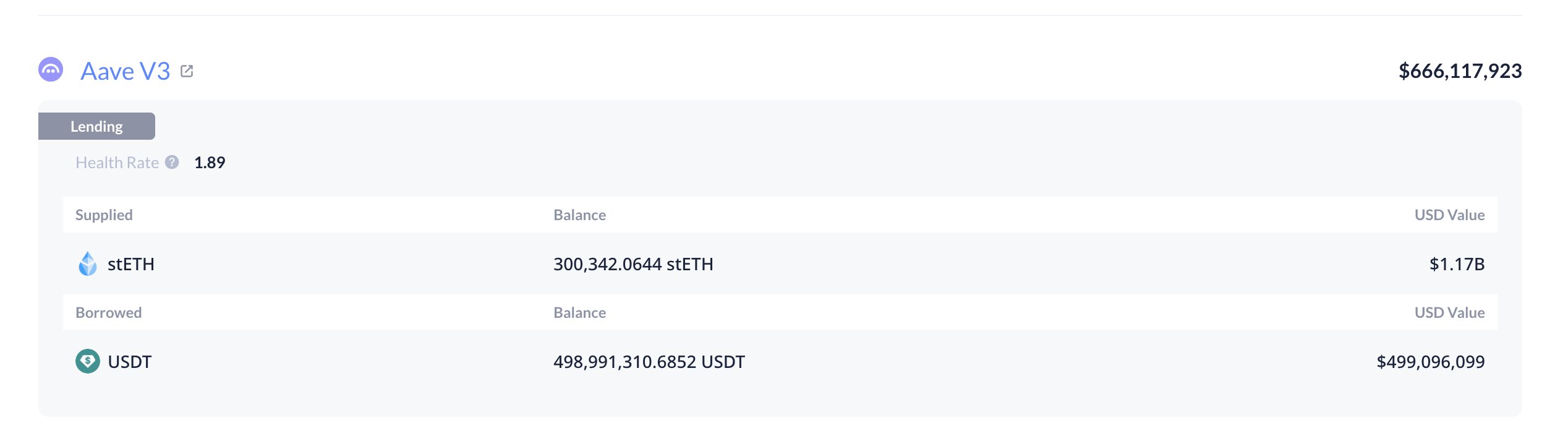

Further delving into the on-chain activities, Lookonchain's data reveals a sophisticated financial maneuver orchestrated by the same Ethereum OG. This individual meticulously deposited 300,000 ETH into Aave, a leading decentralized lending and borrowing protocol, subsequently leveraging this collateral to borrow an equivalent of $500 million in USDT. This intricate interplay between Aave and the newly launched ConcreteXYZ and Stable vaults highlights the strategic acumen of this market participant. Out of an aggregate total of $775 million USDT channeled into these new vaults, this singular whale accounted for an overwhelming 64.5% of the total liquidity, unequivocally cementing their dominant influence in this sudden and impactful market event.

Unpacking the Whale's Lending Strategy

This particular on-chain strategy is a hallmark of highly experienced and sophisticated crypto whales. By deploying a substantial quantity of ETH as collateral on Aave, the whale effectively liberates a significant amount of liquidity—in this instance, $500 million in USDT—without necessitating the outright sale of their underlying Ethereum holdings. This mechanism allows them to retain full exposure to Ethereum's potential long-term appreciation, a critical consideration for long-term holders, while simultaneously unlocking capital that can be strategically deployed into various yield-generating opportunities. The newly launched ConcreteXYZ vaults represent precisely such an opportunity, promising attractive returns on stablecoin allocations.

Broader Market Implications and Risks

The concentration of such an immense volume of liquidity originating from a single entity carries multifaceted implications for the broader cryptocurrency market and the DeFi ecosystem. On one hand, it undeniably signals a burgeoning confidence among deep-pocketed institutional and individual investors regarding the inherent stability, robustness, and profitability of decentralized finance protocols. Such large-scale commitments validate the utility and potential of these platforms. Conversely, this degree of concentration inevitably raises pertinent questions concerning potential market influence and systemic risk. Should a single participant control such a disproportionately large share of capital inflows, their actions, whether intentional or not, could exert considerable sway over market dynamics.

If this substantial borrowed liquidity is primarily allocated towards legitimate yield farming initiatives or strategic, long-term positioning, rather than short-term speculative ventures, it possesses the potential to bolster Ethereum’s foundational ecosystem. This would manifest through an increase in overall DeFi activity, enhanced on-chain engagement, and a deepening of liquidity pools. However, a significant caveat exists: should adverse market conditions prevail, leading to a substantial decline in the collateral value of ETH, the possibility of cascading liquidations could dramatically amplify market volatility. This inherent risk is a critical consideration in any highly leveraged DeFi strategy.

In essence, this monumental Aave-ConcreteXYZ transaction serves as a compelling illustration of how sophisticated whales adeptly leverage advanced DeFi infrastructure. Their primary objectives are to optimize liquidity, maintain a dominant market position, and ultimately exert significant influence over ecosystem-wide capital flows. This series of events solidifies its status as one of the most impactful and strategically significant on-chain maneuvers observed within the current quarter.

Ethereum's Price: Battling Key Resistance

As of recent observations, Ethereum’s price is trading approximately around the $3,964 mark, exhibiting preliminary signs of a modest recovery following a period of heightened market volatility. A comprehensive review of the daily price chart reveals that ETH has consistently endeavored to recuperate losses incurred since its October lows. However, the asset remains firmly ensnared below a critical zone of resistance, spanning from $4,000 to $4,200. This particular range is where the 50-day and 100-day moving averages conspicuously converge, historically acting as a formidable rejection area during phases of market consolidation and price discovery.

Despite encountering some short-term gains, Ethereum’s overarching market structure continues to reflect a palpable sense of uncertainty among investors. While the 200-day moving average, positioned robustly near $3,200, consistently provides strong dynamic support, effectively mitigating the risk of a deeper price capitulation, the persistent inability of ETH to decisively break above the $4,000 threshold leaves the asset vulnerable to renewed selling pressure should broader market momentum wane or turn negative.

Further analysis of trading volume patterns suggests a discernible lack of strong conviction among prospective buyers. Each successive rally attempt has been met with diminishing strength and a gradual erosion of momentum. For Ethereum to re-establish a sustainable and unequivocally bullish outlook, a definitive and robust daily close above the $4,200 level is imperative. Such a breakout would serve as a powerful signal, potentially paving the way for a continued ascent towards the $4,500 mark and potentially higher targets. Conversely, a failure to successfully reclaim and hold this crucial range could precipitate a retest of the lower support levels, specifically around $3,600 to $3,500.

This comprehensive examination highlights that while Ethereum’s price action is influenced by broader market sentiment, the underlying strategic moves by major entities within the DeFi landscape are playing an increasingly critical role in shaping its short-term volatility and long-term trajectory. The interplay between on-chain liquidity dynamics and technical price indicators offers a nuanced perspective on Ethereum's current position and its potential path forward.