Ethereum Price to $20,000: M2 Money Supply Insights

The Global M2 Money Supply, a key indicator of the total amount of money in circulation, has witnessed a consistent ascent over the past year, establishing new record highs. Historically, this chart has been a critical tool for analysts forecasting Bitcoin's price trajectory, with many crediting it for predicting Bitcoin's recent climb to unprecedented levels, even reaching $124,400. The analytical spotlight has now shifted to Ethereum, as experts apply the same Global M2 Money Supply chart to project the altcoin's potential, suggesting it could soon breach the 5-figure mark.

Global M2 Money Supply and Ethereum's Trajectory

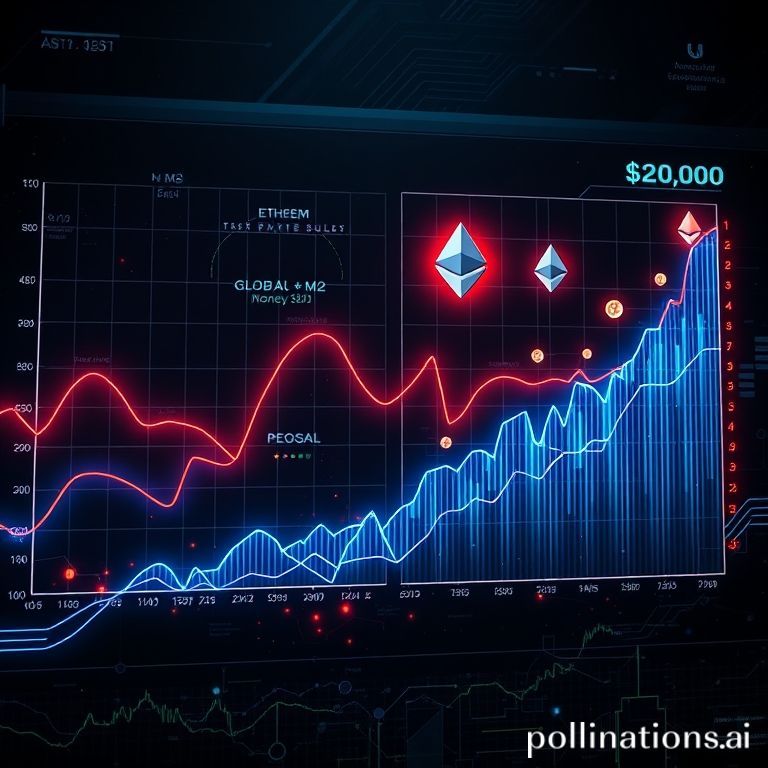

In a fresh approach to Ethereum price prediction, crypto and market analyst Ted Pillows has leveraged the Global M2 Money Supply chart. Through an insightful X post, Pillows overlaid the Ethereum price chart onto the Global M2 Money Supply chart, meticulously illustrating their comparative performance. The M2 money supply broadly includes physical cash, checking accounts, savings deposits, and money market mutual funds. Its growth typically suggests increased liquidity in the financial system, which can often flow into various asset classes, including cryptocurrencies, driving prices upward due to increased demand and purchasing power.

The visual analysis indicates that Ethereum's price is currently trailing the money supply chart, yet its present positioning hints at an imminent surge. Adhering to the trends observed in the Global M2 Money Supply chart, an initial scenario might involve a temporary dip for Ethereum below $4,000. However, this potential short-term decline is paradoxically viewed as a bullish catalyst. This perspective stems from the substantial liquidity concentrated at the $4,000 price level. Should this liquidity be 'taken out' by a price drop, analysts believe it could act as a significant 'gunpowder' reserve, fueling Ethereum's subsequent rally with considerable momentum. Following the established Global M2 Money Supply trend, such a breakout could precipitate an over 300% price increase.

Pillows forecasts that if this scenario unfolds as anticipated, the Ethereum price could skyrocket to a range of $18,000-$20,000, with a projected timeline extending into 2026. Even adopting a more cautious outlook, Pillows estimates that Ethereum could realistically achieve half of this ambitious target, settling around $10,000. Ultimately, the analyst remains firmly optimistic about Ethereum's long-term bullish prospects, regardless of short-term market fluctuations.

The Anticipated $10,000 Ethereum Milestone

Ted Pillows is not alone in predicting a substantial ascent for Ethereum. Another prominent analyst, Titan of Crypto, previously projected that Ethereum would ultimately reach the $10,000 mark within the current year. Titan's analysis highlights a discernible Bull Pennant formation on the chart. A successful breakout from this pattern is widely expected to propel the Ethereum price towards the $10,000 target by the end of the year, assuming market conditions align favorably for such a move. The Bull Pennant is a continuation pattern that signals a temporary pause in a strong uptrend, often followed by a continuation of the prior move.

However, immediate challenges for Ethereum appear to be centered around the $4,000 level, characterized by budding liquidity. Crypto analyst Donald Dean points out that a loss of support at $4,200 would likely see the next significant support level emerge at $4,070. While this might seem like a bearish move, Dean suggests that this $4,070 level could serve as a crucial launch point if it successfully holds. Once this support is confirmed, Dean foresees the ETH price undergoing a 50% retracement, subsequently igniting a rally that could drive the price towards an initial target of $5,766.

These analyses, while varied in their short-term predictions, collectively paint a picture of a cryptocurrency poised for significant growth. The underlying economic principle of an expanding M2 money supply, coupled with compelling technical chart patterns like the Bull Pennant, provides a robust framework for these optimistic forecasts. Investors and enthusiasts are closely watching these critical support and resistance levels, understanding that each movement could be a stepping stone towards Ethereum's much-anticipated multi-thousand-dollar valuation. The confluence of macro-economic indicators and micro-technical patterns suggests a compelling narrative for Ethereum's future in the digital asset landscape.