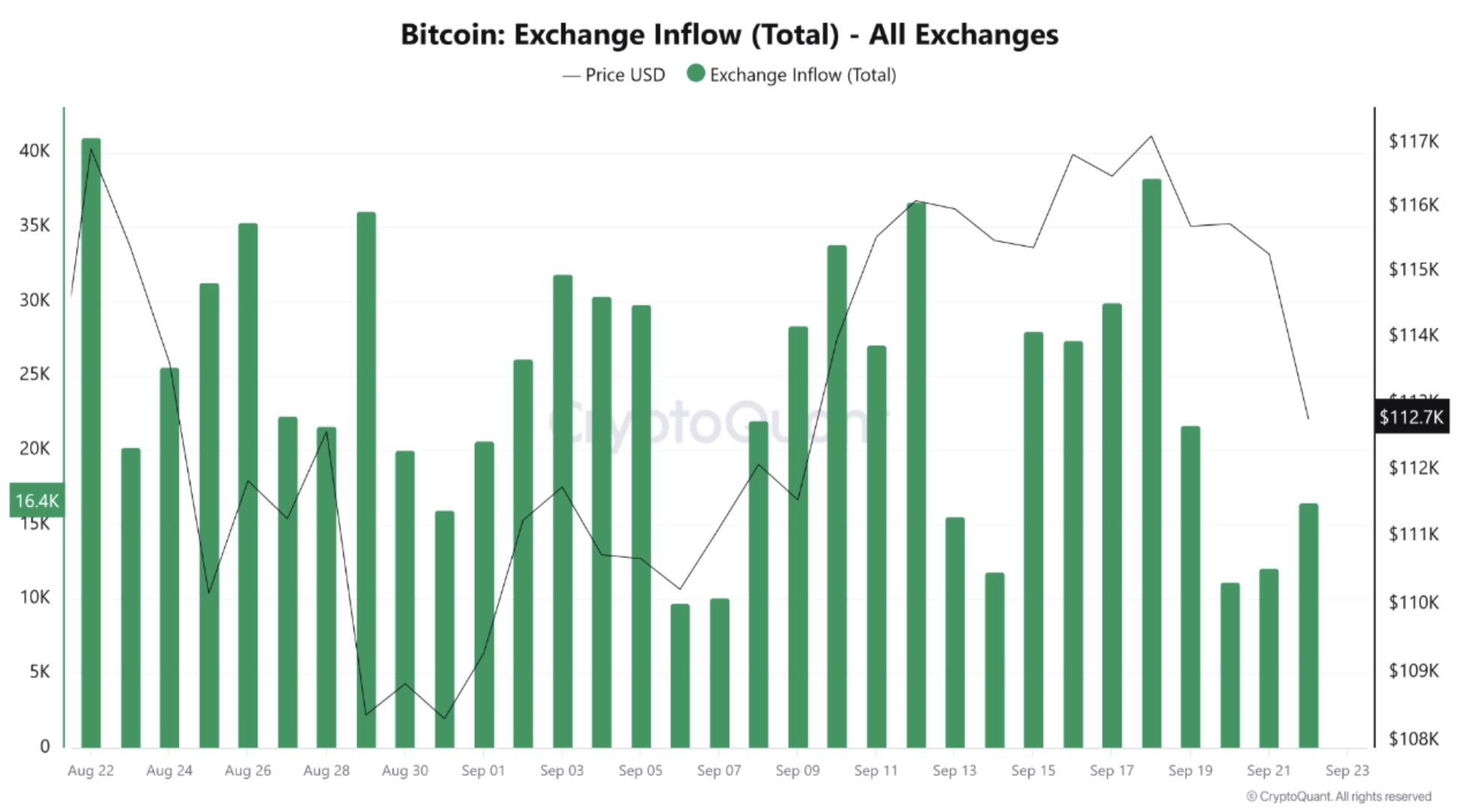

Bitcoin is currently facing bearish pressure as exchange inflows remain elevated. Recent data indicates a concerning trend that could potentially lead to Bitcoin losing its crucial support level at $112,000. Over the past 24 hours, the crypto market experienced liquidations exceeding $1.6 billion, predominantly from long positions, according to data from Coinglass.

Bitcoin Tumbles: Analyzing the $112,000 Support

Bitcoin experienced a decline from approximately $116,000 to a low of $111,800. This downturn reflects broader market volatility fueled by concerns surrounding a potential US government shutdown. Prediction markets on Kalshi currently estimate a 70% likelihood of a shutdown in 2025.

CryptoQuant contributor PelinayPA noted the impact of Bitcoin withdrawals from exchanges during late August and early September. Nearly 65,000 BTC were withdrawn, coinciding with a price recovery for the digital asset. Large outflows typically suggest that investors are transferring their holdings to personal wallets, decreasing immediate selling pressure and indicating a bullish sentiment.

However, recent trends indicate a weakening of these outflows. Since September 20, data reveals that more investors are opting to keep their coins on exchanges. Between September 17 and 19, Bitcoin inflows to exchanges surged to nearly 40,000, while the price declined to $117,000.

Increased BTC inflows to exchanges often indicate that investors are moving coins from private wallets to platforms for selling, signaling a higher selling intent. This situation can create short-term bearish pressure on the price due to increased supply outweighing demand.

PelinayPA noted that during the rally from September 7 to 15, BTC outflows from exchanges exceeded inflows, supporting bullish momentum. However, after September 17, inflows surpassed outflows, leading to selling pressure and a price drop to $112,700. She concluded that high inflows and relatively weak outflows suggest short-term downside pressure. A rebound from the $112K zone is possible if outflows increase, signaling accumulation; otherwise, further downside risk remains.

Should Bitcoin Holders Be Worried?

Bitcoin’s recent drop to $112,000 might not be entirely unexpected. Prior on-chain data suggested potential trouble for BTC due to limited whale participation in the recent rally. The latest price decrease occurred shortly after the US Federal Reserve (Fed) cut interest rates by 25 basis points.

Despite the flagship cryptocurrency’s fall, experts suggest that it is still far from a genuine capitulation. CryptoQuant CEO Ki Young Ju has predicted that BTC could peak at $208,000 during the current market cycle. Currently, BTC is trading at $113,175, reflecting a 2.1% decrease over the past 24 hours.