The landscape of digital currency adoption in the United States continues to evolve rapidly, with Ohio taking a significant step forward. Recently, the Ohio Board of Deposit announced its selection of a vendor to facilitate the acceptance of cryptocurrency payments, specifically Bitcoin (BTC), for various state fees and services. This move positions Ohio as a pioneer in integrating digital assets into government transactions, reflecting a broader trend towards legitimizing cryptocurrencies within state financial systems.

This pivotal decision by Ohio follows a proposal initially passed by the board in May 2025, which formally recognized cryptocurrencies as an authorized financial transaction device. This earlier proposal laid the groundwork for the current implementation, demonstrating a deliberate and forward-thinking approach by the state's authorities. The integration of crypto payments is not merely a technological upgrade but a strategic initiative aimed at enhancing efficiency and catering to the evolving financial preferences of its citizens and businesses.

Ohio Secretary of State Frank LaRose underscored the importance of this development, stating that the Board of Deposit’s choice to accept crypto payments will play a crucial role in maintaining Ohio's competitive edge as a leading state for commerce. LaRose emphasized, “There’s a reason why we now rank among the top five states in the nation to do business. It’s because we’re not afraid to embrace the tools, trends and technologies that incentivize job creators to come here. My office processes hundreds of thousands of financial transactions each year, and we’ve heard a growing demand for a cryptocurrency payment option. I’m excited and ready to be the first to provide it to our customers.” His comments highlight a clear recognition of the growing demand for digital payment options and the state's commitment to innovation.

With this initiative, Ohio becomes the fourth US state to implement digital asset payments for government services, joining Colorado, Utah, and Louisiana. Each of these states has introduced unique frameworks for crypto integration, signaling a diverse approach to adoption across the nation.

Precedents in US States

Colorado led the charge in April 2025, becoming the first US state to accept tax payments in cryptocurrencies. Governor Jared Polis noted that Colorado residents could conveniently use PayPal's Cryptocurrency Hub for these transactions, illustrating how existing financial technology can bridge traditional and digital finance. This early adoption in Colorado set a precedent, demonstrating the feasibility and potential benefits of crypto integration for state revenues.

Utah followed suit with its own significant legislative efforts. Earlier this year, the Utah Senate passed House Bill 230, a comprehensive measure designed to establish custody protections for the state’s burgeoning cryptocurrency mining industry. Beyond mining, the bill also provides explicit rights to run a Bitcoin node, develop software, and participate in staking without undue regulatory interference. This proactive legislative stance in Utah reflects a commitment not only to accepting crypto payments but also to fostering an environment conducive to the broader cryptocurrency ecosystem.

The Next Frontier: State Bitcoin Reserves

While the acceptance of cryptocurrencies for fees and services marks a significant milestone, another frontier in state-level digital asset adoption is the establishment of strategic Bitcoin reserves. This concept involves states holding Bitcoin as part of their treasury, akin to gold reserves, as a hedge against inflation or a long-term investment. This idea is gaining traction, with several states actively considering such policies.

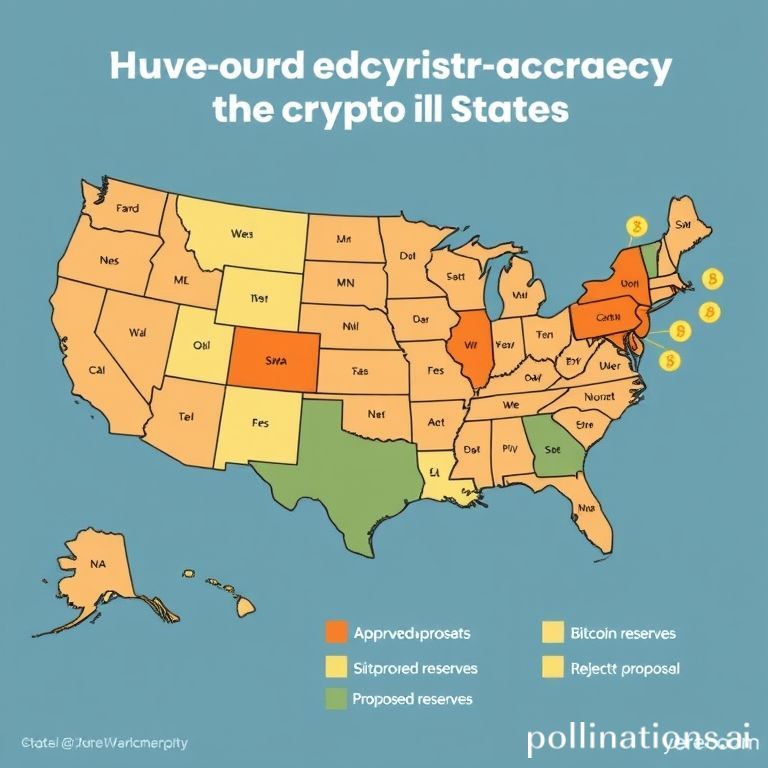

Currently, a select few states have already moved to approve state-level strategic Bitcoin reserve legislation, indicating a more profound integration of digital assets into state financial planning. Texas, Arizona, and New Hampshire stand out as pioneers in this regard, having formally enacted legislation to create their own strategic Bitcoin reserves. Their decisions are based on various economic and strategic considerations, including diversification of assets and embracing a deflationary store of value.

However, the path to establishing state Bitcoin reserves is not uniformly accepted. Several states have explicitly rejected proposals for strategic Bitcoin reserves, citing concerns such as volatility, regulatory uncertainty, or lack of established precedents. Montana, North Dakota, South Dakota, Pennsylvania, and Wyoming are among the states that have chosen not to proceed with such initiatives at this time. This division highlights the ongoing debate and varying comfort levels among policymakers regarding the role of cryptocurrencies in state treasuries.

Furthermore, a substantial number of states, totaling 16, are currently in the proposed stage, meaning discussions and legislative efforts are underway but have not yet resulted in formal approval or rejection. This indicates a dynamic and evolving landscape, where many states are actively exploring the potential benefits and challenges associated with holding digital assets. The outcomes of these ongoing discussions will undoubtedly shape the future of cryptocurrency adoption at the state level across the US.

The momentum observed in states like Ohio, Colorado, Utah, and others signifies a growing recognition of cryptocurrencies as legitimate financial instruments. Whether for transactional purposes or as strategic reserves, digital assets are increasingly becoming a part of governmental financial frameworks. This trend suggests a future where cryptocurrencies play an integral role in public finance, driving innovation and offering new avenues for economic development and efficiency.