Bitcoin has recently experienced a period of notable volatility, momentarily dipping below the $110,000 threshold before a subsequent rebound offered a measure of relief to market participants. Despite this recovery, the broader landscape for digital assets, particularly Bitcoin (BTC), remains fraught with considerable risk. The cautious optimism observed among traders is tempered by warnings from numerous analysts, who suggest that persistent selling pressure could lead to a continued erosion of BTC's upward momentum. This precarious market phase is characterized by a confluence of mixed investor sentiment and an ambiguous short-term directional outlook, making a deeper analysis of underlying market mechanics particularly pertinent.

The Unfolding Trend of Wholecoiner Inflows

A critical on-chain development, highlighted by prominent analyst Darkfost, points to a significant shift in market dynamics: the volume of transactions originating from wholecoiners—a cohort of investors defined by their ownership of at least one full Bitcoin—has receded to its lowest point within the current market cycle. This particular group of investors is traditionally regarded as a robust barometer of market conviction, owing to the substantial symbolic and economic weight associated with holding a complete Bitcoin unit.

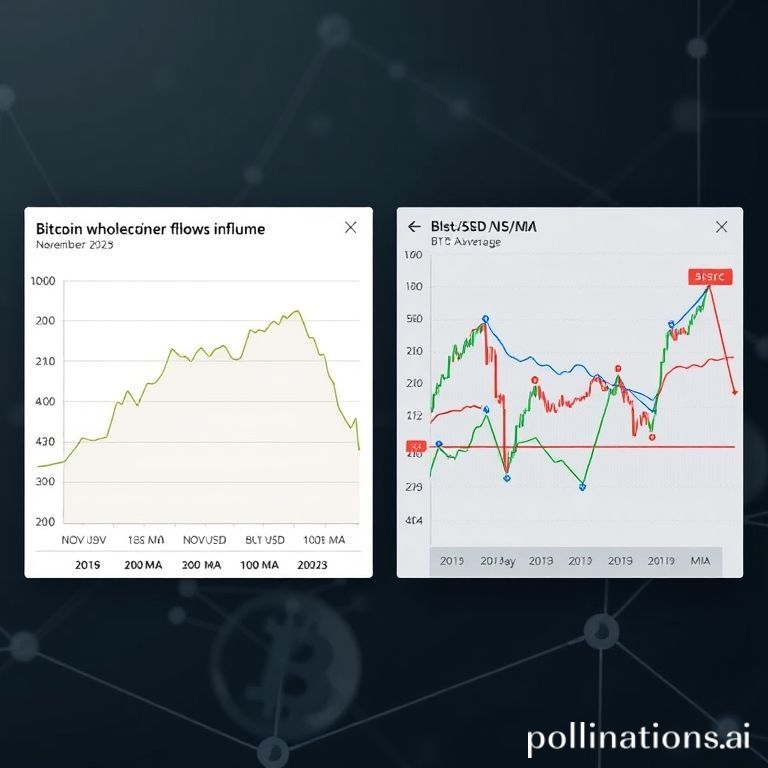

Observational data from major exchanges corroborates this trend. On Binance, for instance, Bitcoin inflows from wholecoiners have seen a sharp contraction, plummeting from a peak approaching 11,500 BTC in November 2023 to approximately 7,000 BTC presently. This pattern is not isolated to a single platform; similar declines are evident across all major exchanges, where the average annual deposits from wholecoiners have fallen from roughly 45,000 BTC in May 2024 to around 30,000 BTC today. This widespread reduction in wholecoiner activity underscores a discernible weakening of engagement among long-term investors, thereby amplifying the prevailing uncertainty surrounding Bitcoin's trajectory. As the supply dynamics tighten and investor conviction undergoes rigorous testing, the immediate future could prove instrumental in shaping BTC's subsequent price movements.

Decoding Market Psychology: The Wholecoiner Signal

Darkfost elaborates on the unique and invaluable nature of wholecoiner behavior as an indicator for discerning Bitcoin's underlying market psychology. Unlike the often speculative and short-term driven activities of day traders, the wholecoiner segment represents a class of investors who have successfully accumulated a minimum of one full Bitcoin. This achievement has become progressively challenging as BTC's price has appreciated over the years, imbuing the possession of a full coin with both considerable symbolic prestige and economic significance. Consequently, close monitoring of this group's actions offers profound insights into long-term market trends.

The correlation between wholecoiner exchange inflows and market sentiment is well-established. An uptick in their deposits often signals a reevaluation of conviction, suggesting that these substantial investors may be more inclined to realize profits or reduce their exposure during periods of market ambiguity, thus contributing to potential selling pressure. Conversely, a reduction in wholecoiner deposits typically reflects a stronger resolve to hold their assets. This mechanical contraction in the supply of Bitcoin available on exchanges serves to alleviate selling pressure and can foster a more stable environment for BTC's price action.

This dynamic is intrinsically linked to Bitcoin's fundamental scarcity principle. As global adoption expands and the distribution of Bitcoin becomes more widespread, the absolute number of individuals classified as wholecoiners tends to stabilize or even marginally decrease. The increasing rarity of acquiring an entire Bitcoin unit further magnifies the influence and symbolic importance of this investor demographic. For market analysts, therefore, diligently tracking wholecoiner flows offers an indispensable lens through which to gauge the conviction and prevailing sentiment that underpin long-term market trends.

Bitcoin's Price Action: Navigating Support and Resistance

Currently, Bitcoin is trading in the vicinity of $112,242, demonstrating a modest recovery following its earlier test of the critical $110,000 support zone this week. Technical chart analysis reveals that BTC has effectively bounced from its recent lows, indicating a degree of short-term resilience within the market. Nevertheless, the upward momentum of BTC appears to be constrained by overhead resistance levels, posing a challenge to sustained price appreciation.

Key Technical Levels:

- Immediate Resistance: The 50-day moving average (represented by the blue line on charts) is converging near the $114,000 mark. This level is anticipated to act as immediate resistance, necessitating substantial buying pressure from bulls to reclaim higher price territories.

- Major Hurdle: Beyond the 50-day MA, a more significant psychological and technical barrier resides around $123,217, which corresponds to the recent peak observed in mid-August. A decisive breakout above this particular level would likely serve as a confirmation of bullish continuation, potentially paving the way for a retest of the $125,000–$127,000 price range.

- Crucial Support: On the downside, the 100-day moving average (indicated by the green line) positioned near $111,000 is currently furnishing a vital cushion against further declines. A failure to maintain price levels above this moving average would expose BTC to more pronounced corrections, with the 200-day moving average (depicted by the red line) situated approximately at $104,000, acting as the subsequent significant support zone.

The interplay of these technical indicators with the on-chain data from wholecoiners creates a complex but critical picture for Bitcoin's immediate future. The market is at a crossroads, where both sustained investor confidence and robust price action are required to overcome the prevailing uncertainties.

Conclusion

The recent decline in Bitcoin wholecoiner inflows to unprecedented lows since November 2023 represents a pivotal development, signaling a cautious recalibration of conviction among long-term holders. This trend, when observed in conjunction with Bitcoin's current technical posture—characterized by a rebound from critical support but constrained by formidable resistance—paints a picture of a market at a crucial juncture. The behavior of wholecoiners remains an indispensable indicator for gauging market sentiment, and their collective actions will undoubtedly play a significant role in determining Bitcoin's immediate future trajectory. As the digital asset navigates this fragile phase, vigilance across both on-chain metrics and traditional technical analysis will be paramount for understanding its next substantial move.