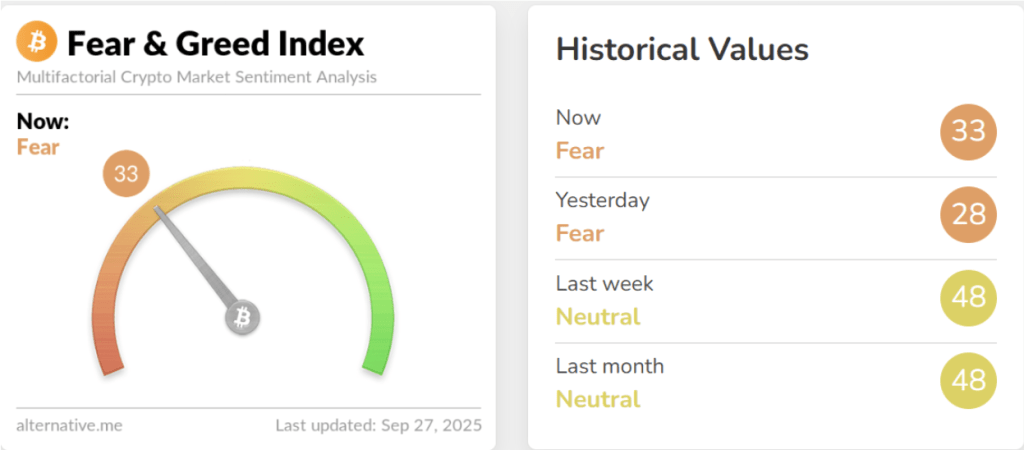

The cryptocurrency market is currently navigating a period of heightened tension, following Bitcoin's recent breach of critical price levels. This downturn has significantly impacted investor sentiment, as evidenced by a dramatic plunge in the Bitcoin Fear & Greed Index. The index, a widely observed barometer of market psychology, plummeted by 16 points within a single day, reaching a low of 28 yesterday—its lowest mark since March. While it has since seen a modest recovery to 33, it firmly remains within the 'Fear' zone. This situation might understandably create apprehension among many investors. However, historical market patterns suggest that such periods of widespread fear could, paradoxically, present significant opportunities for astute Bitcoin investors.

Bitcoin Fear & Greed Index Signals Opportunity

The past week proved challenging for numerous cryptocurrencies, with Bitcoin bearing the brunt of the downturn. After commencing the week above $115,000, Bitcoin entered a sustained decline, eventually falling below the crucial $110,000 threshold. This breach triggered a cascade of liquidations, wiping out over $1 billion worth of positions across the broader crypto industry. The ripple effect was also felt by major altcoins, with Ethereum dipping below $4,000, and other significant players like XRP and Solana experiencing notable losses. These collective movements effectively erased the cautious optimism that had prevailed just a week prior, when the Fear & Greed Index hovered at a more neutral level of 48. The subsequent crash to a low of 28 highlights the rapid and sometimes brutal shifts in market sentiment when key support levels fail to hold.

The Index as a Contrarian Indicator

The sharp fall in the Bitcoin Fear and Greed Index serves as a potent reminder of how swiftly market psychology can reverse. However, for experienced market participants, this fearful mood is often interpreted not as a bearish signal, but rather as a potential opening for long-term strategic plays. The Fear & Greed Index has a well-documented history of acting as a contrarian indicator. Extreme levels of fear, as observed currently, frequently precede significant market rebounds. This principle suggests that periods when the majority of investors are fearful often represent optimal entry points for those willing to take a long-term view.

A compelling illustration of this contrarian behavior can be found in recent history. Back in March, when the index last plumbed similar depths, Bitcoin was trading at approximately $83,000. Today, despite the index once again registering below 30, Bitcoin's price remains significantly higher, hovering around $109,000—a difference of roughly $26,000. This disparity underscores that while sentiment can be volatile, the underlying value and long-term trajectory of Bitcoin may be more resilient than immediate emotional reactions suggest. The fact that Bitcoin maintains a higher value even with similar fear levels indicates a stronger fundamental position compared to previous periods of extreme apprehension.

Constructive Outlook Amidst Fear

From a broader perspective, this recent shift in sentiment could imply that the crypto market is in fact closer to its next recovery phase than many anticipate. The minor recovery of the index to 33 from its low of 28 suggests that some discerning traders are already beginning to position themselves for a potential turnaround. For such savvy investors, Bitcoin's current price levels could represent an invaluable opportunity to accumulate the asset at what might be considered 'discount' prices. True, sustainable rallies in Bitcoin rarely occur under conditions of overwhelming greed, which often lead to speculative excesses and subsequent corrections. Instead, periods of consolidation and price corrections are essential for resetting market sentiment and paving the way for healthier, more sustainable growth trajectories. As crypto analyst Michael Pizzino recently remarked, this latest bout of fear might just be the critical turning point that Bitcoin and the wider crypto market have been patiently awaiting. It is during these times of uncertainty that strong hands can enter the market, laying the groundwork for future gains.

Therefore, this fearful environment, rather than being a cause for despair, could actually be setting the stage for Bitcoin, Ethereum, and other altcoins to build substantial bullish momentum once the current selling pressure finally abates. The immediate focus for the market will be Bitcoin's ability to reestablish and sustain its price above the $110,000 mark. At the time of this writing, Bitcoin is trading at approximately $109,220, indicating that this crucial level is within immediate reach. Overcoming this resistance would be a significant psychological and technical victory, potentially signaling the beginning of a renewed upward trend and a shift away from the current fearful sentiment towards a more neutral, and eventually, greedy market.

Bitcoin Fear And Greed Index. Source: Alternative.me