The cryptocurrency market recently experienced a significant upheaval, with altcoins bearing the brunt of a sharp selloff triggered by widespread leveraged liquidations. This event sent shockwaves across the sector, highlighting underlying vulnerabilities and prompting a crucial test for the stability of digital assets beyond Bitcoin. Ethereum, a bellwether for the broader altcoin market, notably slid below the $4,200 mark, signaling a broad-based weakness. Concurrently, other major altcoins, including Solana, witnessed dramatic drops, shedding more than 10% of their value within a mere few hours. This rapid decline underscores the intensity and speed with which market corrections can unfold, leaving many investors grappling with uncertainty.

This cascading wave of liquidations has ignited a fervent debate among market participants. Investors and analysts are now pondering whether this downturn signifies the beginning of a deeper, more protracted corrective phase or if it is merely a necessary market reset, clearing out excess speculation before the next bullish leg. With billions of dollars evaporated from altcoin valuations in a single trading session, the event has undeniably heightened market jitters, leaving traders on edge and reassessing their positions.

The Accelerated Altcoin Flush

Insights from top analyst Maartunn underscored the severity of the situation, noting that the "Altcoin flush accelerates." This observation points directly to the sheer scale of liquidations, which effectively forced out overleveraged positions from the market. While undoubtedly painful in the immediate term for many traders, such significant resets are frequently viewed as healthy for the long-term sustainability and stability of asset prices. By purging excessive speculation and weak hands, the market can establish a more robust foundation for future growth.

Altcoin Open Interest Suffers Major Blow

Delving deeper into the data shared by Maartunn, altcoins endured one of their most severe flushes in recent memory, with an staggering $8.0 billion in open interest wiped out within a few hours. In stark contrast, Bitcoin experienced a comparatively smaller reduction of approximately $1.5 billion in open interest. This significant disparity clearly highlights the disproportionate impact the selloff had on altcoins, indicating that traders in this segment were significantly more leveraged and thus bore the overwhelming brunt of the liquidation event. Open interest, representing the total number of outstanding derivative contracts that have not been settled, serves as a key indicator of market sentiment and leverage. A sharp drop signifies a mass closing of leveraged positions.

The sheer magnitude of this wipeout is particularly telling. The losses in altcoin open interest were more than five times greater than those observed in Bitcoin. This suggests that speculative positions within the altcoin sector were considerably riskier and, consequently, far more vulnerable to rapid downside movements. While Bitcoin consistently acts as the primary anchor for the crypto market, the widening gap in liquidation impacts between Bitcoin and the broader altcoin market points to a notable shift in investor positioning and overall risk exposure across different digital asset categories.

For investors, this critical event raises several important questions regarding market dynamics. On one hand, a dramatic flush of this nature often succeeds in clearing out excessive leverage from the system, potentially paving the way for healthier and more sustainable price action in the medium to long term. Conversely, the sheer scale of the altcoin losses could also be a harbinger of lingering market fragility and suggests the potential for further volatility if investor confidence does not swiftly return to the market. The coming days and weeks are therefore poised to be decisive for the altcoin sector.

Total Market Cap Excluding Top 10 Analysis

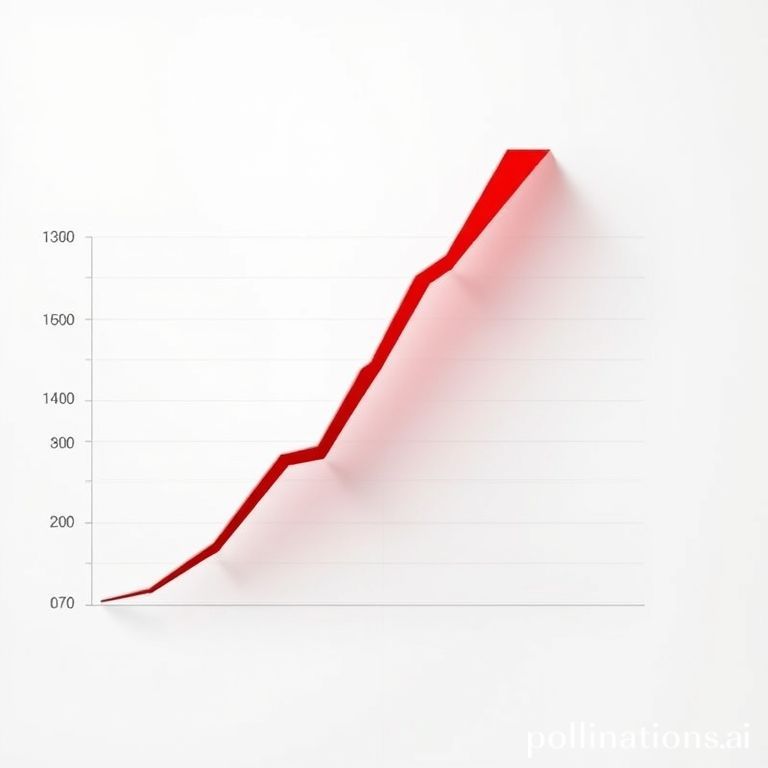

An examination of the total crypto market capitalization, specifically excluding the top 10 coins, offers a revealing perspective on the state of the broader altcoin sector. This metric, often referred to as "OTHERS" on charting platforms, shows that the altcoin segment is currently at a pivotal juncture. Valued at approximately $305 billion, this market segment has demonstrated a significant recovery from the troughs experienced in 2022 and 2023. However, it still remains considerably below its historical peak, which soared above $600 billion, indicating substantial room for potential growth but also highlighting the ground yet to be regained.

Recent price action for this metric reveals that following an extended period of consolidation, altcoins have successfully established a steady uptrend. This positive momentum is strongly supported by the 50-day and 100-day moving averages, both of which are now distinctly sloping upward. Furthermore, the 200-day moving average, a crucial long-term indicator, has flattened out and begun to turn positive. This convergence of upward-trending moving averages collectively signals an improving underlying market structure and a potential shift towards more bullish sentiment in the broader altcoin market. Nevertheless, the recent rejection encountered near the $320 billion resistance level suggests that sellers remain actively engaged at higher price points, posing a challenge to upward movements.

The market's ability to consistently sustain itself above the $280 billion mark will be absolutely critical for preserving its current bullish momentum. A decisive break below this key support level could potentially trigger deeper retracements and renewed bearish pressure. Conversely, maintaining a strong hold above this zone would strongly suggest underlying strength and considerable potential for further expansion. This index, which deliberately excludes top-tier assets like Bitcoin and Ethereum, effectively reflects a rising investor appetite for smaller-cap projects and emerging digital assets.

The notable resilience of this specific sector, even in the face of recent market volatility and liquidations, acts as a compelling signal that risk appetite is gradually but surely returning to the cryptocurrency ecosystem. Should broader market conditions continue to improve and macro factors align favorably, altcoins positioned outside the top 10 could very well emerge as the primary drivers of the next significant phase of market growth and innovation. Investors will be closely monitoring these levels and trends for signs of sustained recovery and renewed enthusiasm.